Smarter, Leaner, Cleaner: Automation Goes Heavy

Industrial automation is coming for carbon–but it’s showing up for cost.

Why Heavy Industry Is Still Stuck in Diesel Mode

Heavy industries like mining, construction, cement, steel, and forestry are responsible for around 25% of global CO₂ emissions, driven by energy-intensive processes and fossil-fueled machines. Cement and steel alone account for roughly 7% each. Decarbonizing these sectors isn’t just about cleaner fuels – it requires rethinking how work is done. That’s where industrial automation comes in.

Technologies like AI, robotics, remote operation, and electrification are now making it possible to run these massive operations more efficiently, safely, and sustainably. Automation isn’t just boosting productivity – it’s becoming a key lever to slash emissions. From autonomous mining fleets to AI-optimized cement kilns and drone-enabled reforestation, industrial automation is starting to reshape heavy industry for the net-zero era.

🏗️ Construction: Wasteful, Diesel-Driven, and Stuck in the Past

The construction industry is one of the least digitized sectors globally – and one of the most carbon-intensive. It’s plagued by diesel-powered equipment, on-site inefficiencies, and massive material waste. Construction and demolition generate up to 40% of global solid waste, while most on-site machines (excavators, loaders, generators) run on fossil fuels, often idling for hours.

Labor shortages and schedule delays lead to more fuel burned, more rework, and more emissions. On top of that, the industry consumes vast amounts of cement, steel, and wood, each with their own heavy climate footprints – making construction both a direct and indirect emissions culprit.

⛏️ Mining: Fossil-Powered and Remote

Mining operations are typically located in remote areas, requiring fleets of large, diesel-burning machines and energy-intensive processes. A single haul truck can burn over 250,000 gallons of diesel per year, emitting ~2,400 tons of CO₂.

Mobile equipment can account for up to 80% of a mine’s operational emissions. Underground mines require continuous ventilation and often involve flying in workers – adding to the total carbon load. Electrification is possible, but automation is the key enabler that makes it viable at scale, especially by allowing remote or autonomous operations.

🧱 Cement, Steel, and Forestry: Hard to Abate and Slow to Modernize

These industries feed the construction sector and face similar challenges:

Cement emits CO₂ from both fossil-fueled kilns and chemical reactions in limestone processing.

Steel production still relies heavily on coal-fired blast furnaces.

Forestry can drive deforestation and emissions if unsustainably managed, and machinery still runs on diesel.

Each of these sectors is critical to infrastructure development, yet difficult to decarbonize without deep changes to process, energy source, and operation. In all cases, the status quo is carbon-heavy by design. Without a fundamental shift in how these industries operate, emissions will remain locked in for decades.

What’s Fueling the Automation Boom

A convergence of pressures – environmental, economic, and technological – is pushing heavy industries to automate faster than ever. Automation is no longer just about productivity or cost savings; it’s now tied to climate targets, energy resilience, and even survival in volatile markets. Here are the key forces accelerating adoption:

Net-Zero Targets and ESG Pressure: From mining to cement, companies are under increasing pressure to cut Scope 1 emissions in line with 2030 and 2050 climate goals. Automation is one of the few levers that can simultaneously reduce emissions, improve safety, and boost efficiency. A 2024 survey found that 77% of mining executives view automation and digitalization as core to their sustainability strategies.

Energy Volatility and Efficiency Mandates: Rising and unpredictable energy costs – especially post-2022 energy shocks – have made energy efficiency a strategic priority. Automated systems powered by AI can optimize heavy equipment, kilns, and industrial processes far more precisely than manual controls. Studies suggest 5–10% additional energy savings are still possible at most industrial sites, even after decades of basic efficiency improvements.

Labor Shortages and Safety Demands: Many heavy industries face aging workforces and increasing difficulty hiring skilled operators – especially for hazardous or remote jobs. Automation fills the gap. For example, one operator can now remotely supervise a fleet of autonomous excavators or trucks from miles away. BHP’s conversion to autonomous fleets in Chile led to 90% fewer worker exposure hours to hazardous zones.

Others

Mature Tech, Ready to Scale: Autonomous vehicles, robotics, and industrial AI are now proven and widely deployable, enabling even legacy operators to upgrade operations with confidence.

Policy and Market Pressure: Regulations like Buy Clean and EU carbon border taxes are pushing suppliers to prove and reduce their carbon intensity – something automation makes possible through both process efficiency and traceability.

Where the Real Innovation Is Happening

Robotics and Remote Operations

Robotics is enabling precise, efficient, and low-waste operations across sectors like construction, mining, and forestry. Robotic arms, automated material placement, and 3D concrete printing can minimize material usage and support the deployment of lower-carbon building materials.

In the field, drones and inspection robots reduce the need for fuel-intensive site visits and help detect leaks or inefficiencies early. Remote operation technologies allow machines to be operated from centralized control rooms, eliminating emissions from travel and enabling around-the-clock usage. This approach not only improves safety but also reduces downtime and energy waste – particularly relevant in hazardous or remote industrial environments.

Autonomous & Electric Heavy Machinery

Heavy mobile equipment – such as trucks, excavators, and loaders – can account for 30–80% of a site’s operational emissions. Shifting this machinery to electric power and layering in autonomy significantly cuts emissions while improving operational efficiency.

Autonomous systems reduce idle time, optimize driving routes, and allow equipment to operate with consistent efficiency. When paired with electrification, these machines can be charged during periods of low grid carbon intensity and deployed in right-sized fleets for better energy performance. Removing the human operator also enables design innovations that improve range, maneuverability, and energy use.

AI and Advanced Analytics

Artificial intelligence is becoming one of the most scalable tools for reducing emissions across heavy industry. AI-powered control systems can dynamically optimize processes such as kiln combustion, smelting, or material flow – achieving 5–10% energy savings even in already-optimized facilities.

Predictive analytics also minimize downtime, identify maintenance needs before breakdowns, and improve throughput – all of which contribute to lower energy intensity. In industrial environments with high variability, AI offers a level of responsiveness and precision that manual systems cannot replicate. Over time, AI orchestration of full site operations may become essential for companies trying to meet strict climate and performance targets.

Other Emerging Areas

Several other areas are rapidly developing: digital twins that simulate and optimize operations in real time; electrification infrastructure like automated charging and smart scheduling systems; carbon tracking and verification tools to meet regulatory and procurement requirements; and frontier automation concepts such as collaborative robot fleets and fully autonomous project planning.

While some of these innovations are still early-stage, they represent promising frontiers for reducing emissions at scale while increasing reliability, safety, and cost-efficiency in the world’s most resource-intensive sectors.

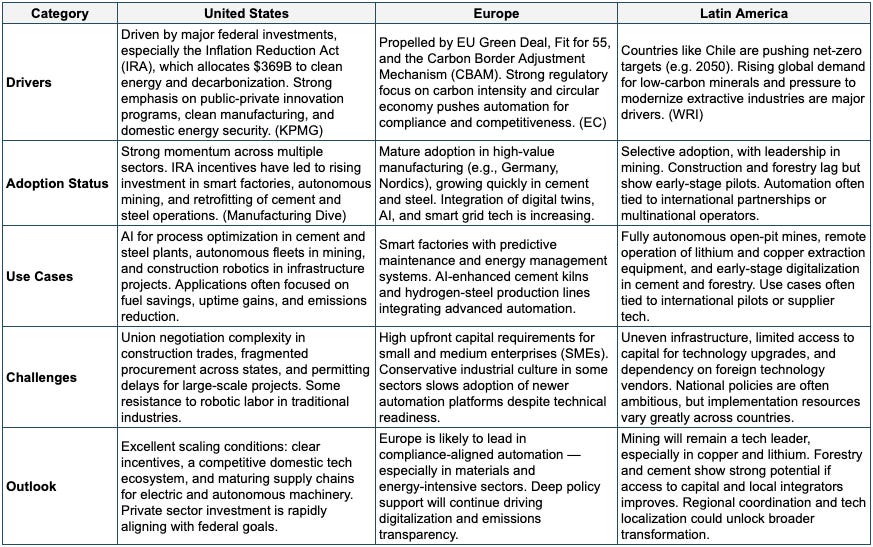

US, Europe, LATAM: 3 Roads to the Same Future

While the push for industrial decarbonization is global, the way automation is adopted – and the reasons behind it – vary widely by region. Some markets are propelled by policy incentives, others by regulatory compliance or supply chain modernization. The table below compares the current landscape across the United States, Europe, and Latin America, highlighting the key forces shaping automation in each.

What emerges is a clear pattern: regions with strong alignment between climate policy, industrial strategy, and technology investment are moving fastest. But even in regions where infrastructure and capital access pose challenges, automation is making inroads – particularly in sectors like mining and construction where emissions intensity and global competitiveness intersect. Understanding these regional dynamics is essential for identifying where the next wave of climate-aligned industrial innovation will take hold.

The Bottom Line: Efficiency Drives Everything

While climate goals, regulation, and ESG mandates are clearly accelerating industrial automation, the deeper force at work is economic logic. The companies adopting automation fastest aren’t just responding to net-zero pledges – they’re chasing greater productivity, uptime, and cost savings.

Across regions and sectors, automation is being embraced not just because it reduces emissions, but because it creates leaner, safer, and more reliable operations. Robotics reduces waste. AI boosts throughput. Autonomy cuts downtime and diesel bills. These operational wins are often what unlock the budgets – and the buy-in.

Yes, policy plays a role – especially in markets like the U.S. and Europe. But the most scalable and sustainable path forward will come from companies that treat decarbonization not as a compliance cost, but as a byproduct of becoming more efficient. In that sense, industrial automation is less about doing less harm, and more about doing more with less.